How Much Does The Average Person Spend In Retirement?

Table of Contents

The average person spends retirement planning and living modestly. They do not spend their days traveling or living extravagantly, but rather enjoy their time at home or with friends and family. Many people find that their biggest expense in retirement is health care.

The average person spends about $1,100 per month in retirement, according to a recent study. This includes costs for housing, food, transportation, and entertainment. However, this number can vary greatly depending on where you live and your lifestyle. For example, retirees in Florida may spend more on transportation than those in other states, while retirees in New York may spend more on housing.

The average person spends about $1,100 per month in retirement, which is a little less than $13,000 per year. This doesn’t include any costs for health care or long-term care.

What Is The Cost Of Living In Costa Rica?

The cost of living in Costa Rica is very reasonable, especially when compared to other Central American countries. The average monthly expenses for a single person are around $1,500, which includes rent, food, transportation, and utilities. Of course, this number can vary depending on your lifestyle and where you live in the country. For example, living in San Jose, the capital, will be more expensive than living in a smaller town. However, overall, the cost of living in Costa Rica is very affordable, especially when compared to developed countries.

How Much Does Healthcare Cost In Costa Rica?

According to a recent study, the average cost of healthcare in Costa Rica is $200 per person per year. This includes both public and private healthcare costs. The study found that the cost of private healthcare is usually about double the cost of public healthcare.

According to the Costa Rican Social Security Fund (CCSS), the average monthly cost of healthcare in Costa Rica is $100 per person. However, this number can vary depending on the type of healthcare coverage you have. For example, if you have private health insurance, your monthly costs will be higher.

The average cost of healthcare in Costa Rica is $200 per month. However, this number can vary depending on the type of coverage you have and the type of healthcare you need. For example, if you need specialized care or treatments, the cost of healthcare will be higher.

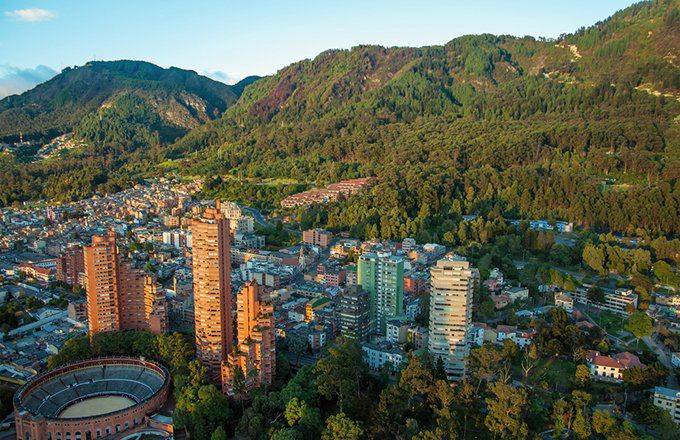

What Are The Best Retirement Cities In Costa Rica?

Costa Rica is well known for its beautiful beaches, lush rainforests, and friendly people. It’s also a great place to retire! In this blog post, we’ll discuss the best retirement cities in Costa Rica.

Costa Rica has something for everyone, whether you’re looking for a quiet beach town to relax in or an active city with lots to do. Here are our top picks for the best retirement cities in Costa Rica:

1. Playa Flamingo: Playa Flamingo is a small beach town located on the Pacific coast of Costa Rica. It’s a popular destination for retirees, as it offers a laid-back lifestyle and stunning ocean views.

2. Tamarindo: Tamarindo is a popular surf town located on the northwest coast of Costa Rica. It’s a great place to retire if you’re looking for an active lifestyle, as there are plenty of activities to keep you busy.

3. Nosara: Nosara is a small town located on the Pacific coast of Costa Rica. It’s a popular destination for retirees and surfers, as it offers a laid-back lifestyle and beautiful beaches.

4. Puerto Viejo: Puerto Viejo is a small town located on the Caribbean coast of Costa Rica. It’s a popular destination for retirees and travelers, as it offers a laid-back lifestyle, beautiful beaches, and a vibrant culture.

5. Cahuita: Cahuita is a small town located on the Caribbean coast of Costa Rica. It’s a popular destination for retirees and travelers, as it offers a laid-back lifestyle, beautiful beaches, and a vibrant culture.

If you’re considering retiring to Costa Rica, these are five of the best cities to consider. Each offers a unique lifestyle and plenty of activities to keep you busy.

What Are The Best Ways To Save Money In Retirement?

As people age, their earning potential decreases while their expenses – including healthcare costs – often increase. For these reasons, saving money becomes increasingly important in retirement.

There are a number of ways retirees can save money, including downsizing to a smaller home, cutting back on travel and entertainment expenses, and eating out less often. Additionally, many retirees are able to take advantage of discounts on a variety of products and services.

Retirees can also save money by living in a more rural area, where the cost of living is often lower than in urban areas. And, of course, retirees can save money by simply spending less.

While there are many ways to save money in retirement, the best approach is to develop a plan that takes into account your unique circumstances and financial goals.

There are a number of ways to save money in retirement, but the best ways vary depending on your individual circumstances.

If you have a pension, you may be able to use it to supplement your income in retirement. You can also use your pension to fund a retirement annuity, which can provide you with a regular income in retirement.

If you don’t have a pension, you may be able to use your savings to supplement your income in retirement. You can also use your savings to fund a retirement annuity, which can provide you with a regular income in retirement.

You may also be able to downsize your home or take in a lodger to help boost your retirement income.

Whatever your circumstances, there are a number of ways to save money in retirement. The best way to save money in retirement is to plan ahead and make sure you have enough money to cover your essential costs.

There are a number of ways to save money in retirement, but the best ways depend on your individual circumstances. Some ways to save money in retirement include:

-Making a budget and sticking to it

-Eliminating unnecessary expenses

-Downsizing your home

– Investing in a retirement account

-Building up a nest egg

-Living below your means

The best way to save money in retirement is to plan ahead and make a budget. By doing this, you can make sure that your retirement savings last as long as possible.